The Definitive Guide to Lamina Loans

Table of ContentsSome Known Details About Lamina Loans Not known Facts About Lamina LoansHow Lamina Loans can Save You Time, Stress, and Money.Some Known Questions About Lamina Loans.Lamina Loans Fundamentals ExplainedThe Buzz on Lamina LoansSome Of Lamina Loans

Online financial has actually been around for numerous years, but on the internet financings have been slower to adapt. There are now plenty of excellent online lenders to pick from.P2P lenders started with business models similar to e, Bay, where any person can apply for a loan by developing a public listing requesting cash, and anyone can bid to lend. The loan providers would pick a rate of interest price that they intended to make and also lendings were funded at the most affordable rate of interest readily available.

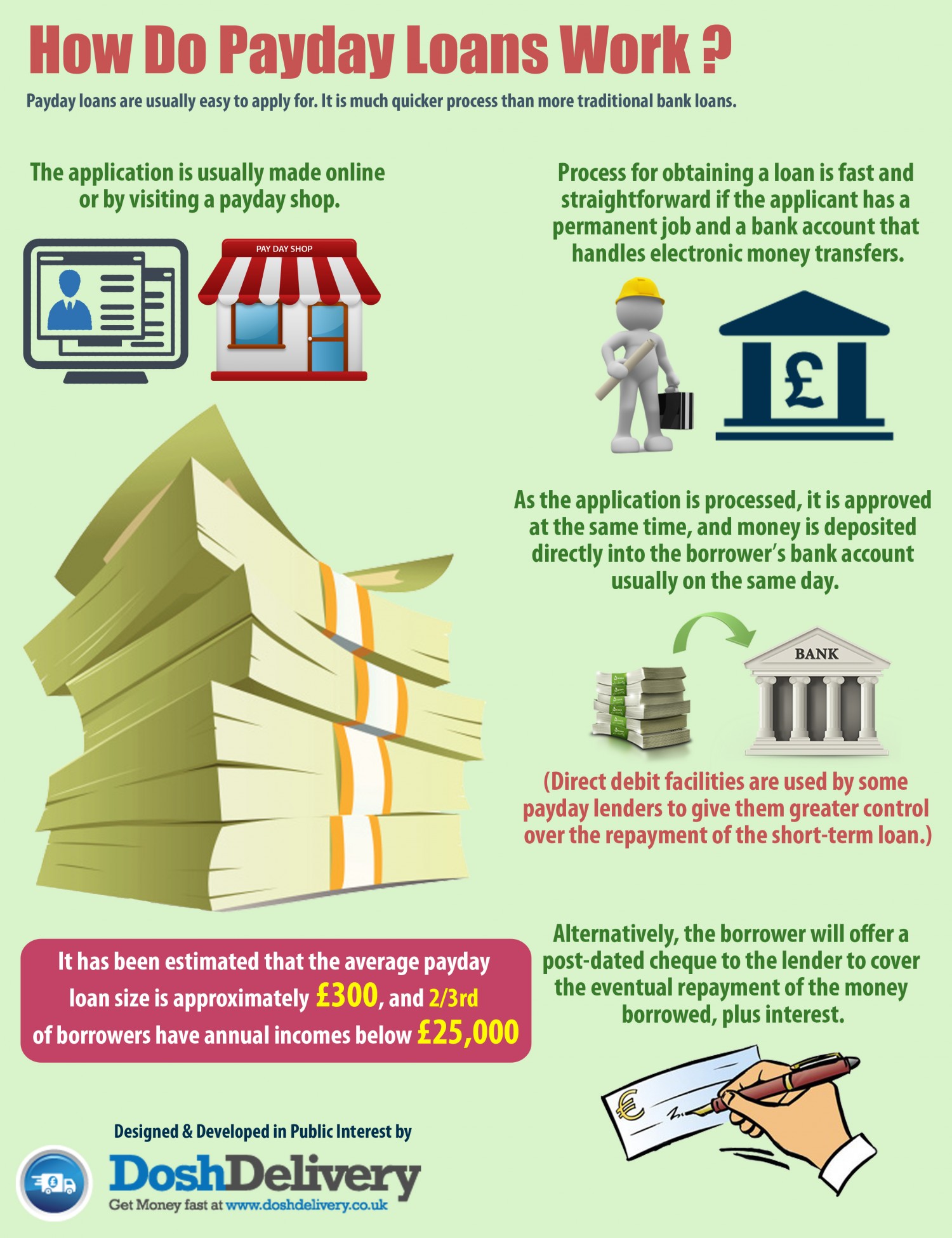

In some situations, people don't do the financing anymorebanks as well as various other huge organizations are the funding resource behind several famous marketplace lending institutions. When looking for on the internet fundings, you'll find lots of results for car loans that are basically payday advance loans. These are high-cost, temporary financings that commonly cause a pricey financial debt spiral.

Rumored Buzz on Lamina Loans

You need to search for financings that you make monthly payments on over a number of years, which you can pay off early without any kind of prepayment fine. Cash advance will certainly be substantially extra pricey than market loan providers - Lamina Loans. You can obtain a charge card with a 20% APR, and lots of on the internet financings bill substantially much less.

You require decent credit history to obtain a decent finance. Any person who will certainly offer to you without inspecting your debt is taking a threat, and they'll expect to be made up for it. Do not obtain from an online lending institution that demands payment upfront. Reputable lenders could bill fees, however those costs come out of your financing proceeds.

To obtain a wonderful financing, you need to search, and online lenders require to be included in your search. Lamina Loans. Stick with trustworthy loan providers, and you need to have the ability to stay clear of trouble. Financial institutions still provide beneficial services and ease, but they're not constantly your best option for loaning.

A Biased View of Lamina Loans

On-line fundings allow you finish the whole borrowing process, from prequalification to finance funding, without ever establishing foot inside a bank branch. They can be a practical way to borrow cash, and also online-only lenders could provide reduced prices or have much less rigid demands than you can locate with standard lenders.

If you have concerns or worries, you'll have to address these online or over the phone. This may be a great or negative point depending upon your comfort degree taking care of finances online as well as whether you live near a bank branch.: Online-only lenders might concentrate their resources on producing straightforward as well as automatic systems that can aid enhance the application and also testimonial process.

Indicators on Lamina Loans You Need To Know

You may have the ability to discover an on-line lender that specializes in individuals that have poor credit history as well as another that concentrates on fundings to those with outstanding credit.: Due to the fact that online-only lenders don't need to build, maintain or staff branches, they may be able to supply lower prices on their loans.

When you collaborate with an online-only lending institution, you may not need to handle as many offers to authorize up for various other items. Whether you intend to deal with an online-only lender or a conventional lending institution, you can look up their minimal requirements, finance offerings, rates of interest varieties as well as prospective repayment terms to identify which lending institutions may be an excellent fit.

One this link advantage of collaborating with on the internet loan providers is that you can swiftly submit numerous prequalification applications to find the finest rates and terms without hurting your credit score. A couple of on-line lenders offer same-day funding when you're authorized. Yet usually, it can take about one to 5 service days to obtain the money as soon as your funding is accepted.

About Lamina Loans

Some lending institutions might also take several days to examine as well as approve your application, and also the process can be postponed if you're delayed in uploading the called for verification papers. Standard financial institutions and also lending institution where you have an account might have the ability to get the cash into your account the same day you're authorized.

Some on the internet lending institutions concentrate on offering to individuals that have bad credit score or are new to credit rating. However also then, you might require a credit report in the mid-500s to low 600s, which can place you in the luxury of the "extremely inadequate" to the "fair" credit rating ranges.

And, if you do get approved, you may receive a high rate of interest price (often much greater than credit rating cards often tend to charge) and low car loan amount.

The smart Trick of Lamina Loans That Nobody is Discussing

:max_bytes(150000):strip_icc()/buying-subject-to-an-existing-loan-1798423-27ea8f47081b44c7b2ba85a2326595e2.jpg)

The testimonials as well as problems article source can also give you insight right into what it may be like to function with the loan provider. Also if a firm is "secure" in the feeling that you'll get a funding, you do not intend to be stuck paying back a finance to a company that has inadequate client service.

10 Simple Techniques For Lamina Loans

99% 24 - 72 months $2,000 - $36,500 7. 99% - i thought about this 35.

We report your repayment background with us to the 3 significant credit rating bureaus, so every on-time payment you make may assist improve your credit report. 6.

If you want your financial resources to have a secure ground to depend on, it aids to have an economic strategy. This suggests you'll require to recognize just how much cash is can be found in, recognize where it's going, and have a well-oiled budget in position. Otherwise, managing things like your rent or mortgage payments, your bills, and your food spending plan might wind up being an obstacle.

Comments on “The Best Guide To Lamina Loans”